From the Fed to Your Front Door: How Federal Reserve Interest Rates Impact Real Estate Investors

Learn how Federal Reserve interest rate changes affect real estate investors, from borrowing costs to market opportunities, and discover strategies to navigate this evolving landscape.

Overview

The Federal Reserve's decision to ease interest rates marks a pivotal moment for real estate investors. After a series of rate hikes beginning in May 2022 to combat rising inflation, the shift in monetary policy opens new doors and poses fresh challenges. But how exactly do these changes at the federal level trickle down to affect individual investors like you?

In this article, we'll unravel the journey of interest rates from the Federal Reserve's announcements to their tangible impact on your real estate investments. We'll also dive into a unique market nuance affecting supply and demand dynamics, giving you a comprehensive understanding of the current landscape.

Understanding the Federal Reserve and Interest Rates

What Is the Federal Reserve?

The Federal Reserve, often referred to as "the Fed," is the central banking system of the United States. It regulates the nation's monetary policy with the dual mandate of promoting maximum employment and maintaining stable prices.

The Role of the Federal Funds Rate

The federal funds rate is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight. While this rate is not directly tied to consumer interest rates, it serves as a benchmark for various short-term interest rates and influences overall economic activity.

Combating Inflation Through Rate Adjustments

When inflation rises—meaning the general price level of goods and services increases—the Fed may raise interest rates to cool off economic activity. Higher rates make borrowing more expensive, which can slow spending and investment, thereby reducing inflationary pressures.

The Journey from Fed Rates to Mortgage Rates

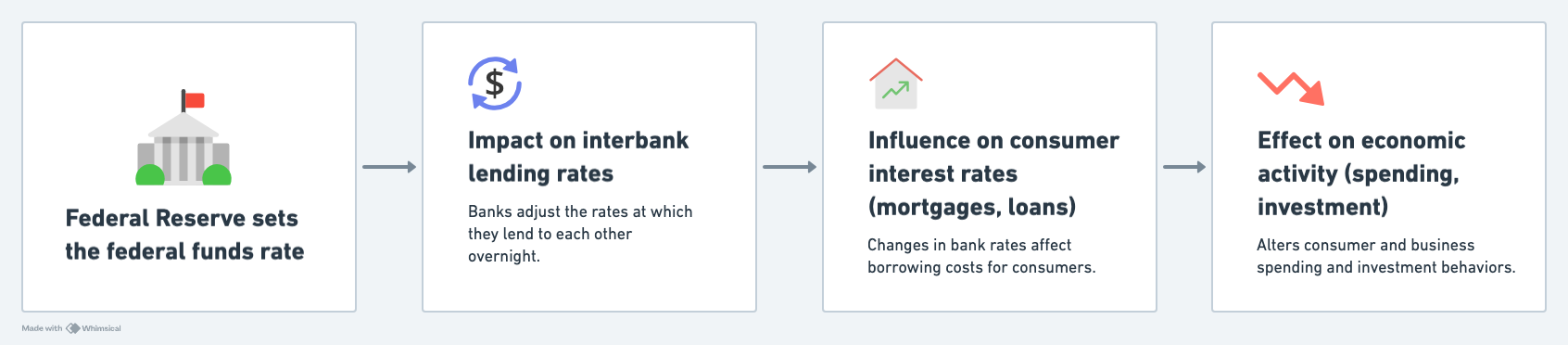

The Ripple Effect

Changes in the federal funds rate set off a ripple effect across the financial landscape. Here's how it works:

- Interbank Lending Rates Adjust: Banks modify the rates at which they lend to each other based on the federal funds rate.

- Consumer Lending Rates Follow: These adjustments influence the prime rate, serving as a basis for consumer loans, including mortgages.

- Mortgage Rates Fluctuate: Lenders alter mortgage interest rates in response to changes in the prime rate and bond market conditions.

The Role of Treasury Yields

Long-term mortgage rates are also influenced by the yields on 10-year Treasury notes. When the Fed signals a rate change, it affects investor expectations, which in turn impact Treasury yields and mortgage rates.

The Lock-In Effect on Housing Supply

Pre-Tightening Era Low Rates

Before the monetary tightening began in May 2022, many homeowners secured 30-year mortgages with historically low interest rates. These favorable terms have inadvertently created a "lock-in effect."

Understanding the Lock-In Effect

- Reluctance to Sell: Homeowners with low-interest mortgages are less inclined to sell their properties because purchasing a new home would likely involve taking on a higher-interest loan.

- Supply Constraints: This reluctance reduces the number of homes available on the market, leading to historically low levels of housing supply.

- Price Inflation Despite High Rates: The reduced supply has led to skyrocketing home prices, even as borrowing costs increased during the period of monetary tightening.

Impact on the Market

- Demand Outpacing Supply: Even with higher borrowing costs deterring some buyers, the severe lack of inventory keeps demand ahead of supply.

- Investor Challenges: For real estate investors, finding suitable properties has become more competitive and expensive.

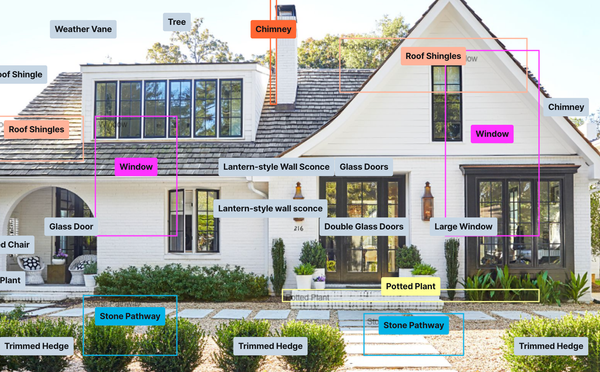

Figure: The impact of rising interest rates and the lock-in effect on the housing market, showing higher prices despite decreased demand.

Changes are Coming to Interest Rates

Easing of the Lock-In Effect

As the Fed begins to lower interest rates:

- Increased Incentive to Sell: Homeowners with low-interest mortgages may feel more comfortable selling, knowing they can secure favorable rates on new mortgages.

- Supply Expansion: More homes entering the market can alleviate some of the supply constraints.

Potential Market Outcomes

- Balancing Supply and Demand: An increase in housing supply could help balance the market, potentially slowing the rate of home price appreciation.

- Opportunities for Investors: More inventory provides investors with a greater selection of properties and potentially better negotiating power.

- Inflation Impact: A stabilization or reduction in home prices contributes to controlling inflation, given that housing costs are a significant component of inflation indices.

Impact on Real Estate Investments

Borrowing Costs

- Lower Rates, Lower Costs: As interest rates decrease, the cost of borrowing diminishes. This means lower monthly payments for mortgages and loans used to finance real estate investments.

- Improved Leverage: Reduced borrowing costs can increase the amount of leverage investors are willing or able to use, potentially expanding the size or number of investments.

Property Prices

- Potential Price Stabilization: With more homes on the market, the rapid increase in property prices may slow down or stabilize.

- Investment Timing: Investors might find more favorable entry points as the market adjusts to the new supply-demand dynamics.

Returns on Investment

- Enhanced Cash Flow: Lower mortgage payments can improve net rental income.

- Capital Appreciation: While property price growth may moderate, strategic investments can still yield significant long-term returns.

Opportunities and Strategies for Real Estate Investors

Navigating the Changing Supply Landscape

- Monitor Inventory Levels: Keep an eye on housing supply metrics in your target markets to identify emerging opportunities.

- Be Prepared to Act: Increased supply can lead to competitive pricing; having financing in place positions you to act swiftly.

Refinancing Existing Loans

- Capitalize on Lower Rates: Refinance higher-interest loans to improve cash flow and overall investment returns.

- Restructure Debt: Consider restructuring your debt portfolio to optimize for the new rate environment.

Expanding Your Portfolio

- Access Cheaper Capital: Lower interest rates make financing new investments more affordable.

- Diversify Assets: With more properties on the market, explore different asset classes or geographic areas to diversify your portfolio.

Risk Management

- Fixed vs. Variable Rates: Evaluate the benefits of fixed-rate mortgages to hedge against future rate fluctuations.

- Stress Testing: Analyze how potential changes in supply and demand could impact your investments under various scenarios.

Conclusion

The Federal Reserve's move to ease interest rates heralds a new chapter for real estate investors. Beyond the traditional impacts of rate changes on borrowing costs and demand, the current landscape features a unique nuance: the potential easing of the lock-in effect that has constrained housing supply.

Understanding how these shifts influence both the supply and demand sides of the market is crucial for navigating the evolving real estate environment. As more homeowners consider selling, increased inventory may offer investors new opportunities while contributing to the broader fight against inflation.

Staying informed and adaptable is your greatest asset in this dynamic market. By aligning your investment strategies with the current monetary environment and market nuances, you can capitalize on opportunities and mitigate risks.

Ready to seize on the opportunites created by a new enviornment decreasing interest rates? Picket offers the tools and expertise to help you navigate these changes and optimize your real estate investment strategy.